A Commuter Parking or Transit Account is a pre-tax benefit account used to pay for public parking/transit—including train, subway, bus, ferry or vanpool—as part of your daily commute to and from work or parking as part of your daily commute to and from work. It’s a great way to put extra money in your pocket each month and make your commute more convenient and affordable.

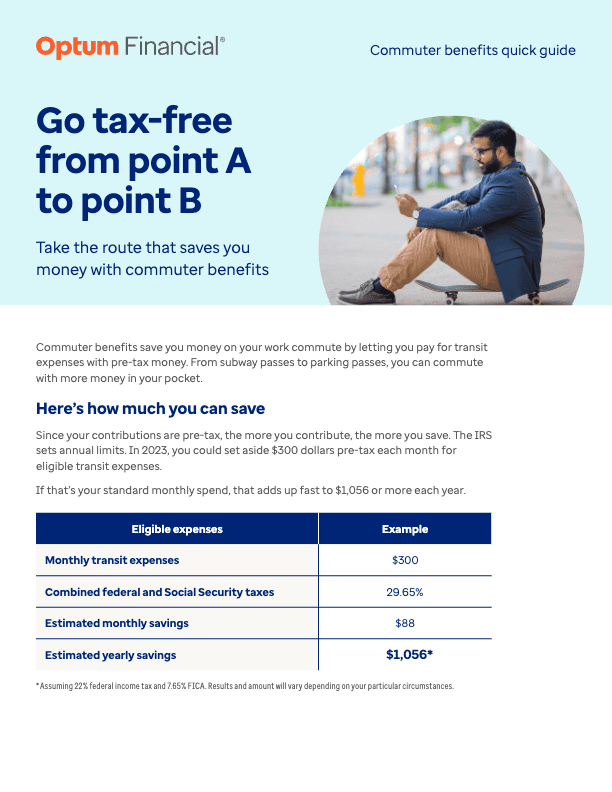

Use up to $300/month in pre-tax dollars to purchase public transit tickets or pay work-related parking fees.

Key Benefits

- Save an average of 30-40% on public transit or qualified parking expenses as part of your daily commute to and from work

- Reduce your overall tax burden — funds are withdrawn from your paycheck for deposit into your account before taxes are deducted

- Choose from a wide range of public transit coverage nationwide

- Convenient order and delivery options save you time

- Variety of payment options make your account easy to use

- Web portal and mobile app access make your account easy to manage

Eligible Expenses

- Buses

- Trains & Subways

- Ferries

- Vanpools

- Commuter Highway Vehicles

- Car Service Apps – UberPool & Lyft Line

Eligible Parking Expenses

- Parking at or neat your place of employment

- Parking at a location from which you commute to work

Ineligible Expenses

- Bridge Tolls

- Highway Tolls

- Expenses For Someone Other Than You

- Fuel

- Mileage

- Uber & Lyft Services (not associated with Uberpool and Lyft Line)

Business travel and other reimbursed expenses are also excluded from this benefit.