The Advantage HSA plan offers the combination of great health coverage with the tax advantages of a Health Savings Account (HSA).

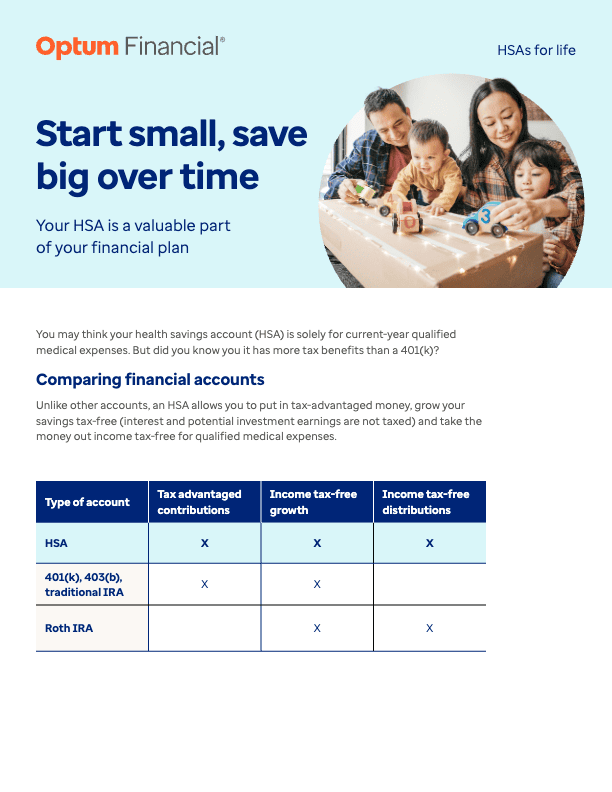

An HSA is like a 401(k) for healthcare. Combined with your company’s HSA-qualified high deductible health plan, an Optum HSA gives you an easy, safe way to lower your healthcare costs today while saving money for future healthcare expenses.

- Pay for today’s eligible out-of-pocket healthcare expenses using tax-free money and put away something extra for tomorrow’s healthcare needs

- Pay fewer taxes this year and in retirement earnings on your HSA funds are tax free.

- Earn money while saving money with no “use it or lose it” risk

Simply decide how much you want to contribute, and funds are withdrawn from your paycheck for deposit into your HSA before taxes are deducted. Use your HSA to pay for everyday eligible healthcare expenses, and any balance left builds your healthcare nest egg. You can even invest your HSA balance and not pay taxes on your gains. The money in your account is yours to keep even if you change jobs, switch healthcare plans, or retire. Unused funds are rolled over from year to year.

HSA Matching

The HSA match is processed per pay period. If an employee enrolls in the Advantage HSA medical plan and contributes to the Optum HSA, Genesco matches the employee’s HSA contribution up to:

- up to $500 per year for employee only coverage

- up to $1000 per year for all other tiers.

Setup/Update Your HSA

To set up or update your HSA contribution:

- Log on to www.mygenesco.com.

- Navigate to Myself > Life Events > HSA Contribution Updates Only.

You must already be enrolled in the Advantage HSA medical plan to contribute to a Health Savings Account.