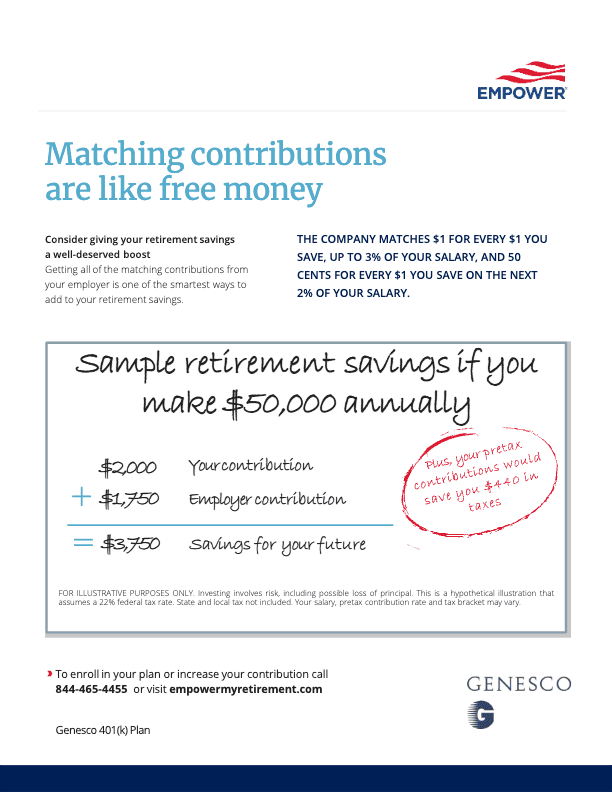

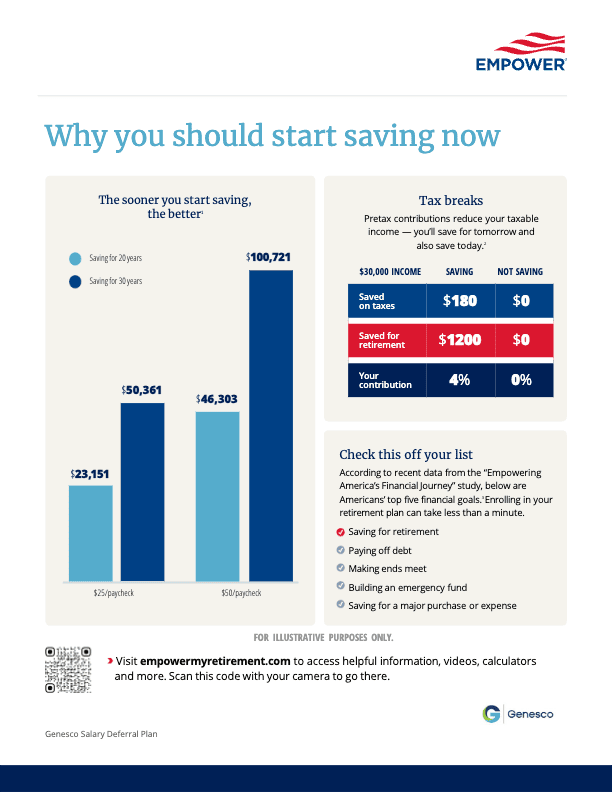

Thinking about your future starts today. What do you imagine life will look like in 30-40 years? What kind of lifestyle do you want? Will you have a family? A secure retirement doesn’t happen by accident – having a savings plan in place can help turn your long-term goals into reality.

Genesco will match 100% on the first 3% you contribute and 50% on the next 2% that you contribute. All contributions and earnings are 100% vested immediately, so the money is yours from day one.

2025 Contribution Limits

Employees can contribute a maximum amount of $23,000 to a 401(k) account. If you’re 50 or older, you can deposit an extra $7,500 in catch-up contributions, for a combined maximum contribution limit of $30,500. These limits apply to all 401(k) contributions, even if you split them between Pre-tax and Roth contributions, or you have two employers in a year and two separate 401(k) accounts.

2026 Contribution Limits

Beginning in 2026, employees can contribute up to $24,500 to their 401(k) account.

If you are age 50 or older, you may contribute an additional $8,000 in catch-up contributions, bringing your total possible contribution to $32,500 for the year 2026.

These limits apply to all 401(k) plans combined, even if you:

- Split contributions between Pre-tax and Roth, or

- Work for multiple employers with more than one 401(k) account

Important Change: Roth Catch-Up Requirement

Starting January 1, 2026, the IRS will require that catch-up contributions be made as Roth for employees whose 2025 FICA wages exceed $150,000. *This update is based on the increased 2025 FICA wage threshold and applies only to employees eligible for catch-up contributions.

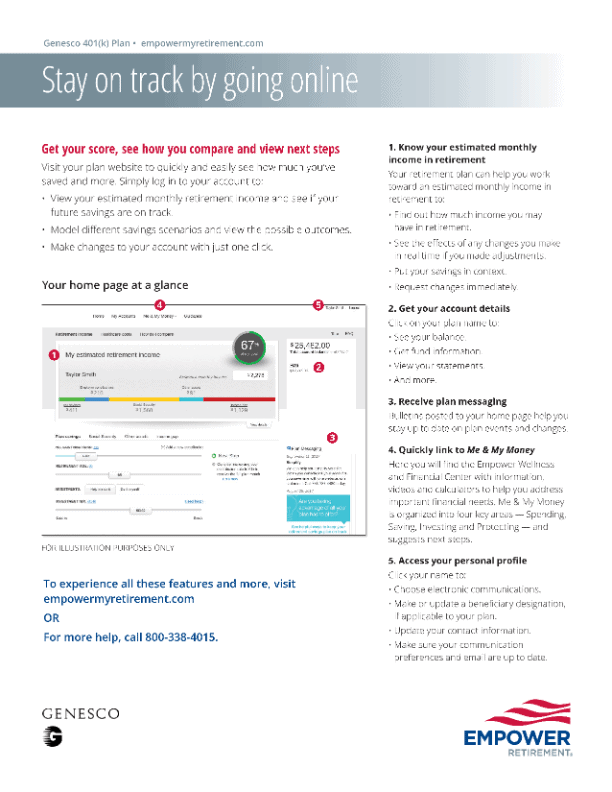

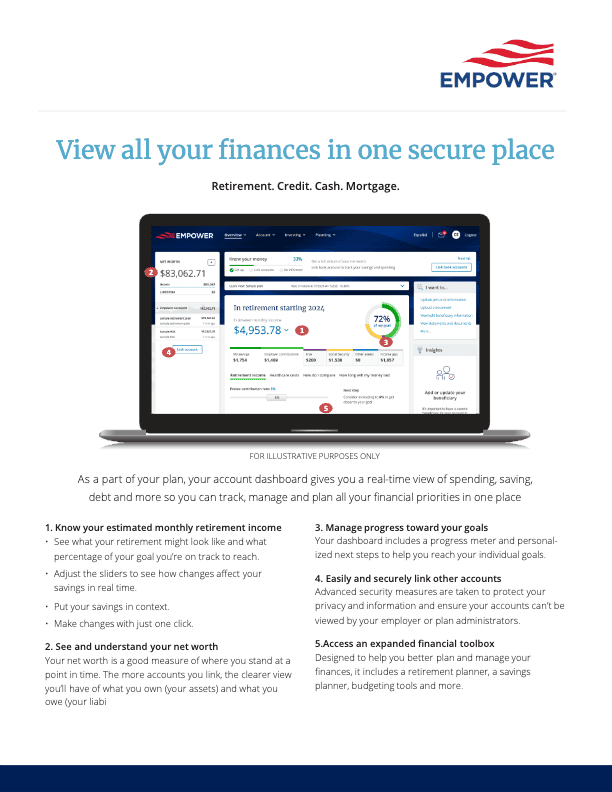

Visit EmpowerMyRetirement.com to make your 401(k) elections and start saving today! View the documents below for more information on how these plans work and how to enroll.

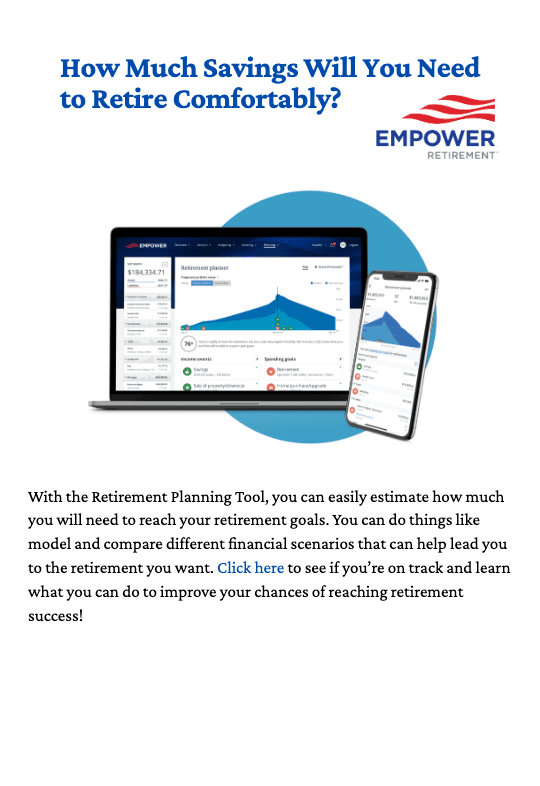

How Much Savings Will You Need to Retire Comfortably?

With the Retirement Planning Tool, you can easily estimate how much you will need to reach your retirement goals. You can do things like model and compare different financial scenarios that can help lead you to the retirement you want. Click here to see if you’re on track and learn what you can do to improve your chances of reaching retirement success!

Notice

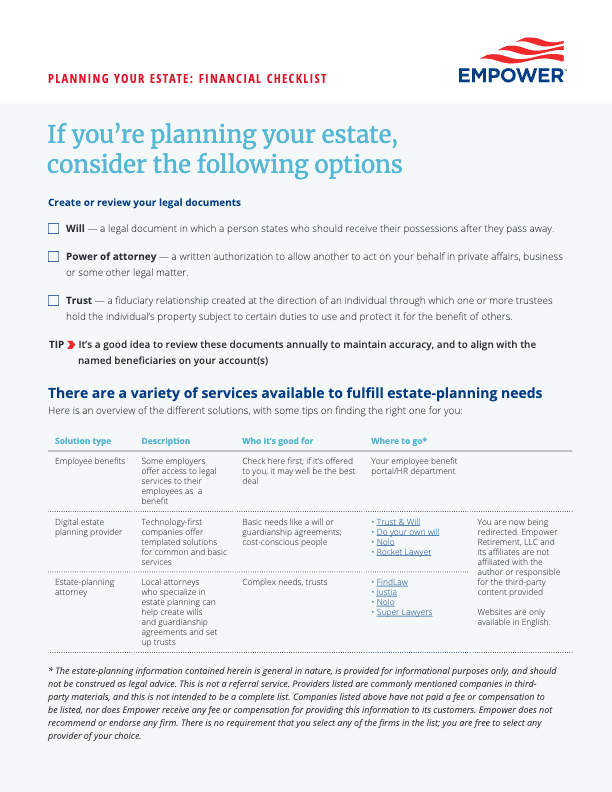

Designating/updating your retirement plan beneficiary via the Empower website is important since it’s a separate election from other benefits. Click here for instructions on setting up your beneficiary