As we prepare for the upcoming year, we want to ensure you are equipped and informed about the changes to your benefits for 2026. While we face some cost adjustments, we are also excited to introduce new opportunities designed to support you and your family in achieving overall wellbeing and financial savings. Continue reading to learn more about what’s changing for 2026 including some new benefits available to you and your family.

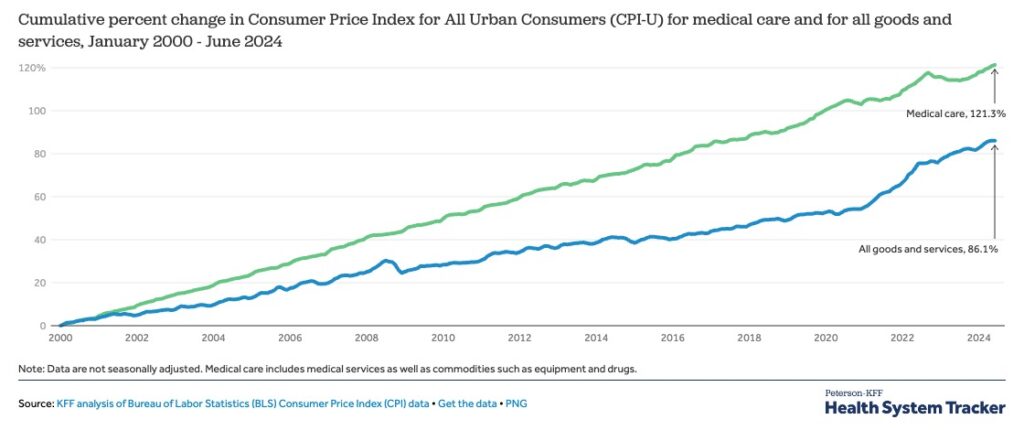

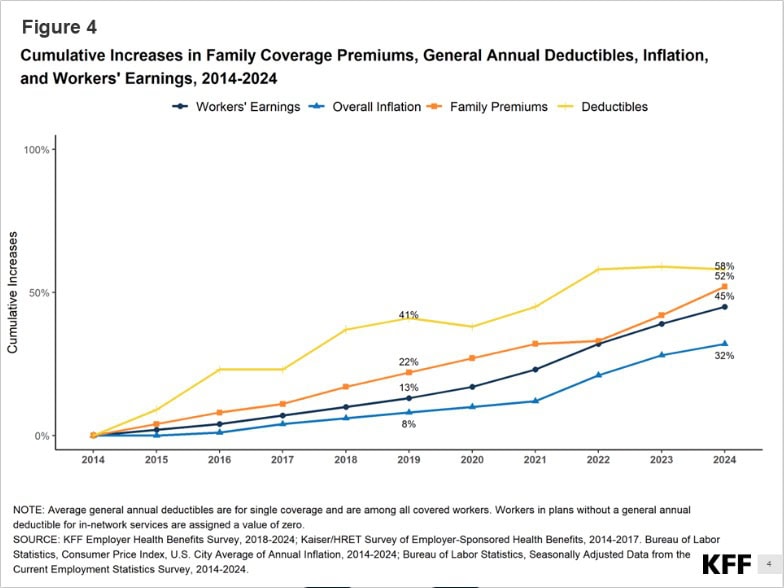

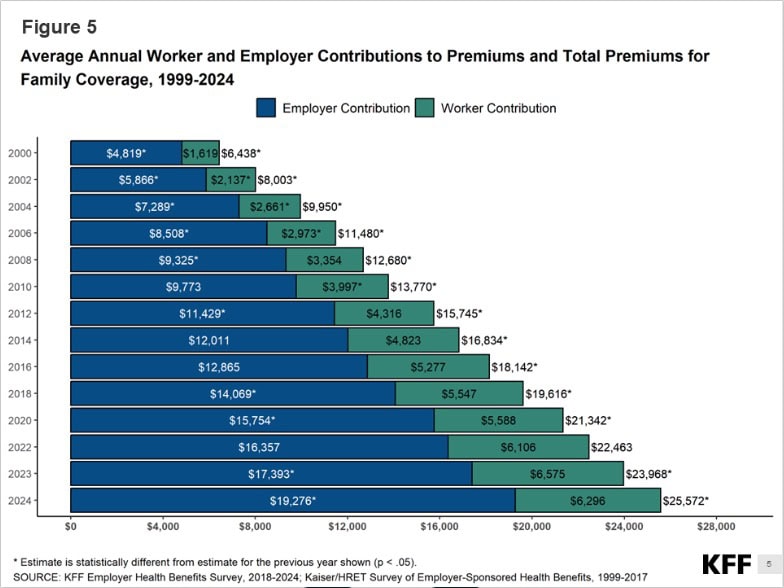

The Landscape of Healthcare Costs

In recent years, the landscape of healthcare has undergone significant transformations. National trends show rising healthcare costs driven by a surge in mergers, breakthrough treatment programs, increasing patient needs, IRS changes to deductibles and OOP maximums, and inflation.

These trends are impacting our own medical benefits. The demand for new, advanced treatments and the increased use of healthcare services have driven up our overall costs. This means that while we're gaining access to more effective healthcare solutions, they come at a higher price. We want to make sure you understand these changes and how they impact your benefit options. By staying informed and making healthy choices we can help mitigate these rising costs together, and continue to provide comprehensive coverage options for Genesco’s employees and their families.

Healthcare Plan Changes

Interactive Plan Review Tool

Select your current plan and coverage level from the choices here to see what's changing for 2026.

Here's what's changing with the Essential plan

| 2025 | 2026 | |||

|---|---|---|---|---|

| In Network DeductibleIndividual/Family | $4,750 / $9,500 | $5,000 / $10,000 | ||

| In Network OOPIndividual/Family | $9,200 / $18,400 | $10,600 / $21,500 | ||

| Plan changes – Rx Copay | ||||

| Generic Copay | $10 | $15 | ||

| Brand Preferred | $100 | $150 | ||

| Retail non-preferred | $150 | $200 | ||

| Monthly Premiums | ||||

| Employee only | $102 | $107 | ||

| Employee + Spouse/Domestic Partner | $256 | $267 | ||

| Employee + Child(ren) | $230 | $240 | ||

| Employee + Family | $333 | $346 | ||

Here's what's changing with the Protect plan

| 2025 | 2026 | |||

|---|---|---|---|---|

| In Network DeductibleIndividual/Family | $1,200 / $2,400 | $3,500 / $7,000 | ||

| In Network OOPIndividual/Family | $8,000 / $16,000 | $8,500 / $17,000 | ||

| Plan changes – Rx Copay | ||||

| Generic Copay | $10 | $15 | ||

| Brand Preferred | $100 | $150 | ||

| Retail non-preferred | $150 | $200 | ||

| Monthly Premiums | ||||

| Employee only | $159 | $166 | ||

| Employee + Spouse/Domestic Partner | $396 | $416 | ||

| Employee + Child(ren) | $357 | $375 | ||

| Employee + Family | $515 | $541 | ||

Here's what's changing with the Advantage plan

| 2025 | 2026 | |||

|---|---|---|---|---|

| In Network DeductibleIndividual/Family | $1,650 / $3,300 | $1,700 / $3,400 | ||

| In Network OOPIndividual/Family | $3,300 / $6,600 | $6,000 / $12,000 | ||

| Plan changes – Rx Copay | ||||

| Generic Copay | 10% after deductible | $10 | ||

| Brand Preferred | 15% after deductible | |||

| Retail non-preferred | ||||

| Monthly Premiums | ||||

| Employee only | $210 | $229 | ||

| Employee + Spouse/Domestic Partner | $524 | $572 | ||

| Employee + Child(ren) | $472 | $515 | ||

| Employee + Family | $681 | $744 | ||

No problem!

Getting coverage for the first time can be daunting. Explore your options on the medical plan page, and consider asking Alex, your interactive benefits advisor, for assistance selecting the best plan for your needs.

Looking for more?

For a complete summary of all the medical plan options, visit the medical plan page.

Review All Medical Plans

Need help choosing a plan?

Ask Alex, your interactive benefits advisor, for assistance selecting the best plan for your needs.

Ask Alex for HelpHealth Insurance Myths

While it may seem like there is little we can do as individuals to help mitigate the rising cost of care nationally, there are some things you can do to help control the costs of your Benefits@Genesco.

If I’m young and healthy, I don’t need insurance.

False. The truth is unexpected accidents and illnesses can happen to anyone. Without insurance the costs can quickly become overwhelming. Even a low-premium plan can help save you a lot if misfortune strikes. Your insurance also covers preventive care visits and some screenings. Not all illnesses are detectable without a test and regular preventive care can help catch issues before they become more expense and tougher to treat.

My health impacts my insurance premiums.

True! The healthier we are as a team, the better rates we are able to negotiate on behalf of our employees. Eating and sleeping right, exercising, maintaining a healthy weight, and getting preventive screenings and early treatment all help contribute to a healthier population. If we all strive to improve our health as individuals, we will all benefit together!

There isn’t much I can do as an individual to help reduce my healthcare expenses.

False! There is a lot you can do to help minimize your care costs. Regular preventive screenings, eating healthy, exercising regularly and getting good sleep all contribute to better health, lowered stress and better overall well-being. This is one of the key reasons we launched Well@Genesco, to help you identify opportunities to be a better you!

Insurance only covers hospital and doctor visits.

False! Your Benefits@Genesco also covers things like preventive screenings, mental health services, financial consulting, cutting out nicotine and more. Enrolling in a medical plan is just the start, as enrolling in your annual benefits opens the door to a lot of other opportunities.

It's more cost-effective to pay out-of-pocket for all my healthcare expenses.

False. While it could seem cheaper initially, unexpected medical events can lead to costs far exceeding those of having insurance, especially when catastrophic coverage is needed.

What Else is New for 2026?

Introducing Well@Genesco

Did you know that Genesco offers a ton of benefits in addition to medical coverage to help with multiple aspects of your well-being? It’s true! That’s why we launched Well@Genesco in the summer of 2025. Whether you need physical help (like nutrition counseling, maternity services, or fitness coaching), financial support (ID theft, legal assistance, or financial planning) or emotional support (counseling, child care referrals, education planning, elder care, and more).

Learn more about Well@Genesco

Meet ComPsych, your new EAP vendor

The Employee Assistance Program (EAP) provides counseling and support services to help with a plethora of issues you might be facing outside of work. Get up to 6 free sessions per year, with a trained professional that can help guide you through life’s daily challenges when needed.

Effective January 1, 2026.

New Discount Program!

We’re excited to introduce PerkSpot as a new benefit for all Genesco employees. PerkSpot is an exclusive online discount platform offering employees savings on a wide range of products and services, helping you stretch your paycheck further than ever. To sign up, please visit genesco.perkspot.com. (Community Code: Genesco)

Learn more & Sign up today!Available beginning October 20, 2025.

Discounted Pet Insurance

Have a furry family member at home? Then we have great news, as Genesco now offers discounted rates on pet insurance from MetLife. The plans work at any licensed veterinarian in the US, cover some pre-existing conditions, and there are no breed restrictions. Help keep your furry family safe with discounted policies from MetLife. To sign up, please visit www.metlifepetinsurance.com.

Learn moreAvailable beginning November 1, 2025.

New Prescription Discount Program

Ever run into an issue where your medical plan doesn’t cover a medication? This new benefit from CVS/Caremark provides discounts on prescription medications, over-the-counter products with a prescription, and some diabetic supplies at a nationwide network of pharmacies, including CVS and other participating stores. You don’t have to wait till January for this benefit, you can enroll and start saving on non-covered medications today!

More Information Coming Soon.Available now!

Expanded Short Term Disability coverage for all

Beginning Jan. 1, 2026 all eligible full-time employees will automatically* receive company-paid short term disability coverage for up to 60% of their base salary, at no charge to the employee. Previously this benefit was available for corporate employees and as a paid option for retail and distribution center employees.

We are also offering the option to buy-up to 80% salary coverage for a small premium. Here's an example of what your benefit would pay out depending on which option you choose:

If you earn $1,000/week

60% Plan

pays $600/week

Maximum Benefit: $1,500

80% Plan

pays $800/week

Maximum Benefit: $2,500

*Benefit payments begin after a 7-day waiting period unless you are hospitalized.

Short-term disability insurance provides you with a portion of your income for a limited period if you're unable to work due to a temporary illness or injury. The buy-up option is a low-cost way to make sure you have even more financial support while you recover.

Learn more